The Racial Wealth Gap: A Brief History

A concise history that uncovers the roots of this most pernicious American divide and makes an urgent call for reparations.

Why has the racial wealth gap between the median white households and median Black households remained stagnant over the past century, never narrowing below six to one? Leading expert on race and financial equality Mehrsa Baradaran attempts to answer this question in this sweeping yet accessible history. She shows how decades of the laws rooted in white supremacy—from slavery and the broken Reconstruction-era promise of “40 acres and a mule,” to the racist policies of the Jim Crow and New Deal eras—have restricted Black access to capital, credit, homeownership, and other mechanisms of wealth creation while subsidizing the rising economic fortunes of white families.

In The Racial Wealth Gap, Baradaran outlines two tectonic forces that have driven apart the economic fortunes of white and Black families: wealth creation for white Americans, who have been systematically receiving financial subsidies in the century and a half since emancipation, and wealth destruction for Black Americans—either by vigilante violence or by official means, such as allowing Black banks to collapse or building highways through segregated Black communities. These forces, combined with the racist notion that Black communities fail to rise because of their own moral, intellectual, or economic shortcomings, have kept Black families behind their white counterparts, despite decades of civil rights activism and national economic growth—a deep injustice that can only be achieved through reparations.

An infuriating and compelling read, The Racial Wealth Gap offers a devastating analysis of one of America’s most pressing systemic issues.

Reviews

“Legal scholar Baradaran (The Quiet Coup) lays out a concise and erudite case that today’s staggering racial wealth gap is the result of decades of carefully crafted government policy. She begins with slavery, “the scaffolding upon with the American economic system was constructed” and, in legal terms, the literal theft of wages. She goes on to show how the theft of Black wealth remained a core tenet of public policy after Emancipation. Particularly damning examples include the government’s history of suppression of successful Black-owned banks, as well as the myriad ways in which white people have been beneficiaries of government-provided safety nets, subsidies, land grants, and legal favoritism. At the same time, Baradaran notes that America’s systemic theft of Black wealth ultimately hurts all average Americans, as it mainly functions to funnel money into the hands of the 1% and to stymie local economies. Baradaran’s quietly furious prose deftly guides readers through the labyrinthine world of American monetary policy and financial history, with breathtaking moments of clarity striking like lightning, as when she notes that the massive amounts of money printed by the Fed to bail out banks during the Great Recession was “trillions more” than had ever been asked for reparations. Readers will be fired up.”

— Publisher's Weekly

The Quiet Coup

With the nation lurching from one crisis to the next, many Americans believe that something fundamental has gone wrong. Why aren’t college graduates able to achieve financial security? Why is government completely inept in the face of natural disasters? And why do pundits tell us that the economy is strong even though the majority of Americans can barely make ends meet? In The Quiet Coup, Mehrsa Baradaran, one of our leading public intellectuals, argues that the system is in fact rigged toward the powerful, though it wasn’t the work of evil puppet masters behind the curtain. Rather, the rigging was carried out by hundreds of (mostly) law-abiding lawyers, judges, regulators, policy makers, and lobbyists. Adherents of a market-centered doctrine called neoliberalism, these individuals, over the course of decades, worked to transform the nation―and succeeded.

Reviews

“Baradaran deftly weaves key events in the history of neoliberalism into a complete picture. Using a keen, critical eye, she walks readers through pivotal Supreme Court cases, the dominance of the religious right within modern conservatism, and the removal of usury caps that used to prevent the institution of loans with extreme interest. Rather than a clear, quick power shift, the “quiet coup” has been just that: a series of small, often imperceptible shifts with radical repercussions for legal and economic policy.

Essential reading to understand the economic state of the nation.”

— Kirkus Reviews

The Color of Money

When the Emancipation Proclamation was signed in 1863, the black community owned less than one percent of the United States’ total wealth. More than 150 years later, that number has barely budged. The Color of Money pursues the persistence of this racial wealth gap by focusing on the generators of wealth in the black community: black banks. Studying these institutions over time, Mehrsa Baradaran challenges the myth that black communities could ever accumulate wealth in a segregated economy. Instead, housing segregation, racism, and Jim Crow credit policies created an inescapable, but hard to detect, economic trap for black communities and their banks.

The catch-22 of black banking is that the very institutions needed to help communities escape the deep poverty caused by discrimination and segregation inevitably became victims of that same poverty. Not only could black banks not “control the black dollar” due to the dynamics of bank depositing and lending but they drained black capital into white banks, leaving the black economy with the scraps.

Reviews

“Lays out how, over centuries, policymakers wrote Black Americans out of the economic system…Baradaran’s work resonates now as millions protest around the U.S.—speaking out not only against police brutality against Black Americans, but the systemic racism that pervades America’s institutions.”

— Huffington Post

“Extraordinary… Baradaran focuses on a part of the American story that’s often ignored: the way African Americans were locked out of the financial engines that create wealth in America, and the way the rhetoric of equal treatment under the law was weaponized, as soon as slavery ended, against efforts to achieve economic equality.”

— Ezra Klein, The Ezra Klein Show

-

Print length: 384 pages

Language: English

Publisher: Belknap Press

Publication Date: September 14, 2017

The Color of Money

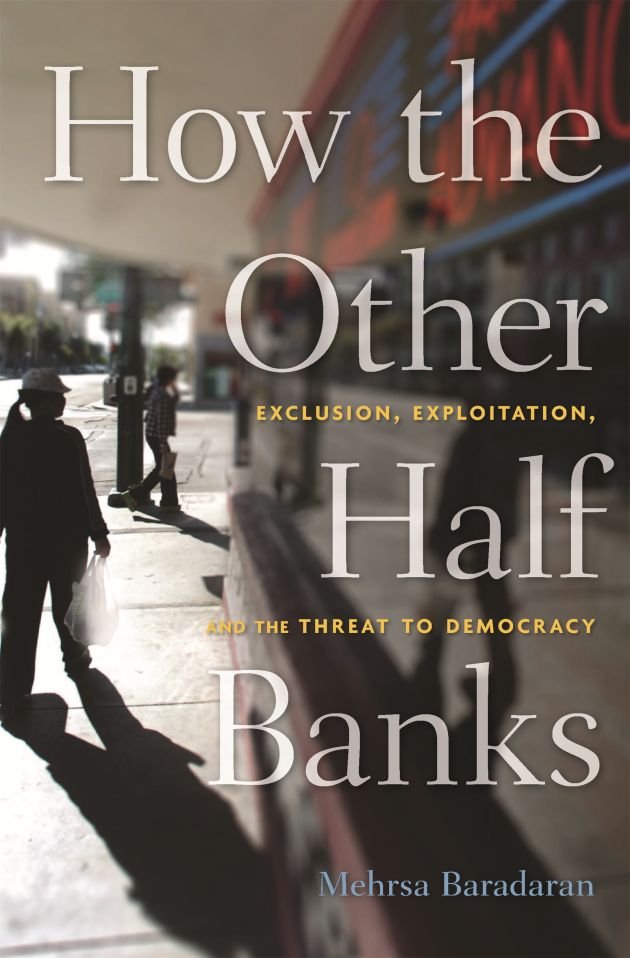

The United States has two separate banking systems today—one serving the well-to-do and another exploiting everyone else. How the Other Half Banks contributes to the growing conversation on American inequality by highlighting one of its prime causes: unequal credit. Mehrsa Baradaran examines how a significant portion of the population, deserted by banks, is forced to wander through a Wild West of payday lenders and check-cashing services to cover emergency expenses and pay for necessities—all thanks to deregulation that began in the 1970s and continues decades later.

Reviews

"Baradaran argues persuasively that the banking industry, fattened on public subsidies (including too-big-to-fail bailouts), owes low-income families a better deal…How the Other Half Banks is well researched and clearly written…The bankers who fully understand the system are heavily invested in it. Books like this are written for the rest of us."

— Nancy Folbre, The New York Times

"How the Other Half Banks tells an important story, one in which we have allowed the profit motives of banks to trump the public interest."

— Lisa J. Servon, American Prospect

-

Print length: 336 pages

Language: English

Publisher: Harvard University Press

Publication Date: October 6, 2015